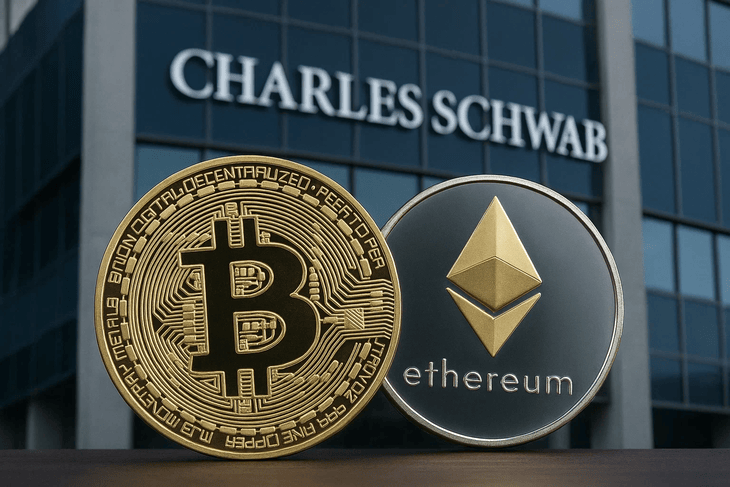

Charles Schwab CEO Confirms Crypto Integration: BTC and ETH Trading Imminent

Charles Schwab is preparing to enter the cryptocurrency market, with CEO Rick Wurster revealing that spot trading for Bitcoin and Ethereum will soon be available on its platform. This move reflects a growing demand from Schwab’s clients, many of whom currently hold a small portion—typically 1–2%—of their wealth in crypto via third-party platforms. Schwab aims to make it easier for these clients to consolidate their holdings within a single, trusted environment. By enabling direct crypto trading, Schwab hopes to enhance convenience, strengthen security, and streamline portfolio management for its users.

The announcement was made during Schwab’s strong second-quarter earnings call, where the company reported $5.8 billion in revenue and more than 1 million new brokerage accounts. Wurster described crypto trading as a natural next step and a promising growth area. The firm already serves as a custodian for about 20% of all U.S.-based crypto ETPs, representing $25 billion in crypto assets out of a massive $10.8 trillion under management.

This planned rollout positions Schwab as a potential competitor to established crypto platforms like Coinbase, targeting clients who want the ease of managing both traditional and digital investments in one place. Wurster also hinted at future developments, including the launch of stablecoin-related services, as Schwab keeps pace with evolving regulatory landscapes like the GENIUS Act.

While no exact timeline was given, Wurster stated that the feature is expected to roll out “soon,” marking a significant step in Schwab’s digital transformation. As traditional financial giants like Schwab embrace crypto, the lines between legacy finance and decentralized assets continue to blur—offering more choices to investors looking to diversify in the digital era.