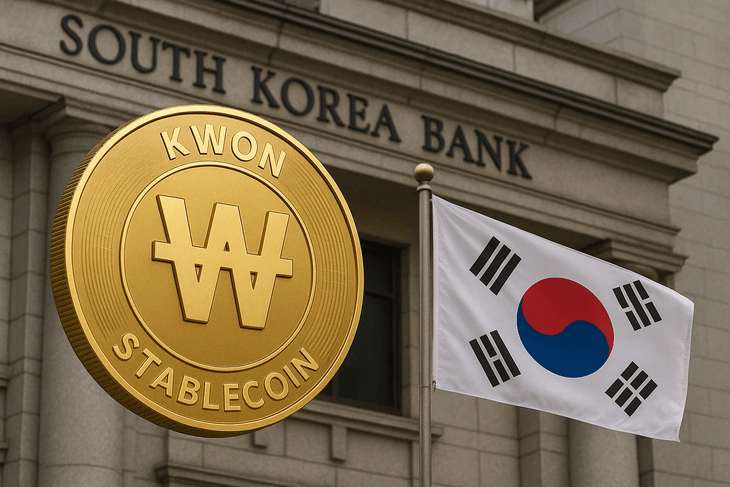

South Korea’s Major Banks Unite to Launch K-Won Stablecoin

In a bold move to reshape its digital finance landscape, South Korea’s top eight mega-banks are preparing to launch a new won-pegged stablecoin—dubbed “K-Won”—marking a major step toward domestic financial sovereignty and innovation. Led by a consortium including KB Kookmin, Shinhan, Woori, NH Nonghyup, IBK, Jeonbuk, and Suhyup, the project aims to counter the growing dominance of U.S. dollar-backed stablecoins like USDT and USDC, which saw over $40 billion in capital flight from South Korea in Q1 2025 alone.

The K-Won initiative comes amid growing political and regulatory support for a homegrown stablecoin ecosystem. Backed by the administration of President Lee Jae-myung, the move is intended to promote local liquidity, strengthen the national currency in the digital economy, and offer a compliant alternative to overseas crypto solutions. The Bank of Korea is also playing a key role, advocating for a gradual rollout through regulated financial institutions before expanding to fintech players.

This effort is unfolding alongside South Korea’s broader push to finalize the Digital Asset Basic Act, which will provide a legal framework for stablecoin issuance, reserve requirements, and oversight. However, the initiative isn’t without hurdles—concerns remain about foreign exchange risks, international acceptance, and the infrastructure needed to support a scalable launch.

If successful, K-Won could become the world’s first widely adopted national stablecoin backed by a major banking alliance, reshaping the role of traditional finance in crypto adoption. The launch is expected later this year, with pilot programs and regulatory announcements likely over the coming months. South Korea is now positioning itself at the forefront of stablecoin innovation—setting the stage for what may truly become a global “K-Won shockwave.”